Ever feel like your business is stuck in the pile of unpaid invoices, desperately waiting for payments from customers?

Hylobiz transforms your business processes from manual and time-consuming to streamlined, eliminating the hassles of overdue payments. This ensures a steady cash flow and strong financial health.

In this blog, we will speak about our collection automation feature and how it helps businesses across industries to get paid on time and control cash flow. However, before we speak about our product, we will cover some insightful strategies for efficiently managing accounts receivable and achieving faster collections.

What is Accounts Receivable?

Accounts Receivable refers to the outstanding payments that a business has yet to receive from its customers or clients for goods or services provided.

In simpler terms, it represents the money owed to a company by its customers. When a business extends credit to its customers, creating invoices for products or services delivered, the amount mentioned in these invoices that is awaiting payment is considered part of the account receivables.

Importance of Managing Account Receivables

- Managing accounts receivable is crucial for a company’s cashflow and overall financial health, as it impacts the timely collection of funds owed to the business.

- Timely management of account receivables ensures that a company has the necessary funds to meet its operational expenses, invest in growth opportunities, and handle unforeseen financial challenges.

- Effective receivables management minimizes the risk of bad debts and late payments, enhancing the stability of the company’s financial position.

- It allows for accurate financial forecasting and strategic planning, empowering businesses to make informed decisions for sustainable growth.

Essentially, a well-managed account receivables process is not just about getting paid promptly, it helps build financial stability, customer satisfaction, and long-term success for businesses.

A Detail on Accounts Receivable Management with Hylobiz

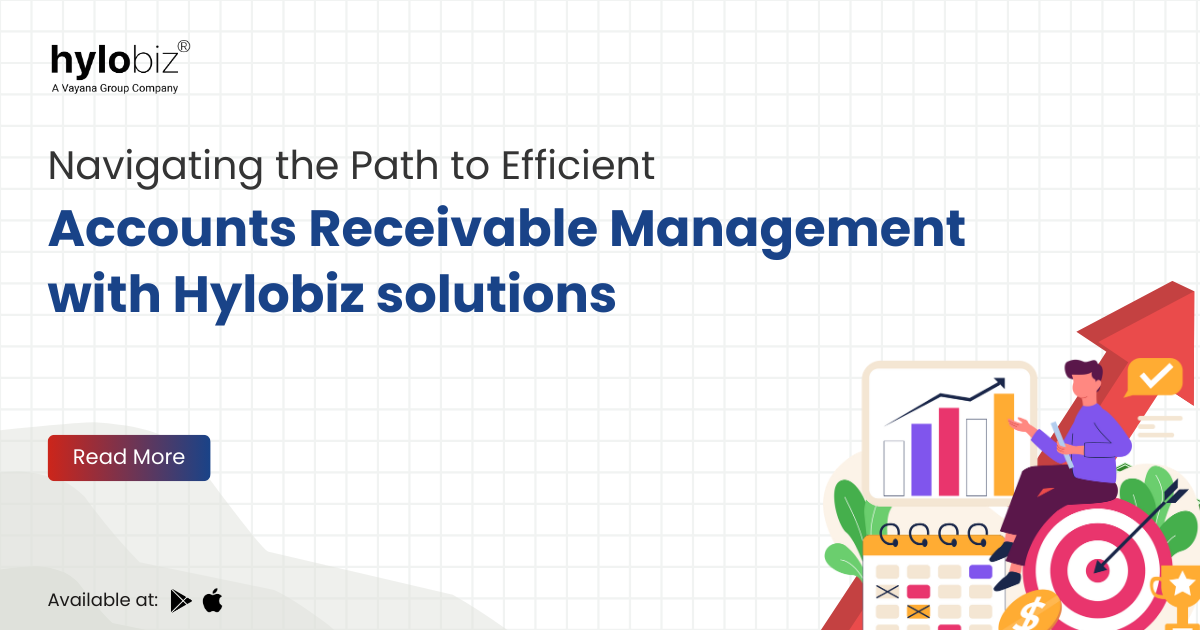

If you did not know about us, Hylobiz is a fintech solution that helps businesses get paid on time, and maintain a positive cash flow through a suite of powerful features. It revolutionizes account receivable management through:

- Dashboard & Reports – Businesses can effortlessly track unpaid invoices using Hylobiz’s intuitive dashboards and comprehensive reports.

- Payment Reminders – Utilize the payment reminders feature to gently prompt customers, nudging them to fulfill outstanding payments promptly.

- Payment Links – Expedite collections by sending payment links directly to businesses awaiting payment, facilitating faster and smoother transactions.

- Multiple Payment Modes – Hylobiz accommodates diverse preferences, allowing customers to settle invoices through various payment modes, including credit, debit, and cash.

- Automated Reconciliation – Maintain pinpoint accuracy in financial records. Hylobiz automates reconciliation, and cross-verifying payments with existing records to eliminate errors.

- ERP Integration – Seamlessly connect existing ERPs to streamline the invoicing process. Generate invoices effortlessly through the Hylobiz platform, enhancing overall efficiency in cash flow management.

Hylobiz isn’t just a tool; it’s a strategic partner designed to empower businesses to manage receivables and help them reach new heights in their business journey.

Key Benefits of Hylobiz Accounts Receivable

We serve businesses globally streamlining their cashflow process and ensuring their growth.

Yet to use Hylobiz? Don’t delay further. You can benefit from it.

- Enhanced cashflow Visibility – Businesses gain a clear understanding of their financial health through Hylobiz’s comprehensive dashboard, offering real-time insights into the transactions.

- Automated Workflow – Hylobiz reduces manual intervention, minimizing errors and accelerating the overall accounts receivable process.

- DSO Reduction – With Hylobiz, businesses can actively work towards reducing (Days Sales Outstanding) DSO accounts receivable, ensuring a quicker turnaround from invoicing to payment receipt.

- Secure Transactions – Prioritize the security of financial transactions. Hylobiz employs robust measures to ensure the confidentiality & integrity of account receivables data.

- User-Friendly Software – Hylobiz has an easy-to-use interface, so new people can also easily navigate the software.

Conclusion

Essentially, manage accounts receivable with Hylobiz isn’t just about organized invoices; it transforms your business with an intuitive interface and a suite of powerful tools. This assists in gaining cashflow visibility and automates workflows, which helps to scale confidently.

Hylobiz is the strategic ally for simplifying receivables management and accelerating businesses towards growth. So wait no more. Join the network of successful businesses who could overcome their cashflow challenges like delayed collections, tedious reconciliations, poor cashflow and more with us.

Try Hylobiz for seamless account receivables management and quicker collections!

Frequently Asked Questions

How to manage accounts receivable effectively?

Effective account receivables management is crucial for businesses financial health. Businesses can manage outstanding payments with Hylobiz using these key steps

1. Automation –Hylobiz provides tools like payment reminders, payment links, automated reconciliation and streamlined invoicing processes to ensure timely payments.

2. Real-time Tracking – our solution has dashboards and reports to give businesses an up-to-date overview of their accounts receivable status.

3. Payment Convenience – businesses can provide multiple payment modes for customers to pay, offering convenience to them and accelerating the payment process.

4. Data Security – Prioritize data security to build trust with clients. Hylobiz employs secure encryption and two-factor authentication(2FA) to protect sensitive financial information.

5. Reconciliation: We facilitate automatic reconciliation for businesses, reducing the likelihood of errors and ensuring accuracy in records.

By incorporating these practices, businesses can enhance their accounts receivable management, promoting financial stability and sustained growth.

How to collect accounts receivable faster?

To collect accounts receivable faster, consider implementing the following strategies:

1. Clear Invoicing – Provide detailed and clear invoices promptly to avoid confusion and encourage timely payments.

2. Set Clear Payment Terms – Clearly communicate payment terms and expectations upfront to set clear expectations for clients.

3. Automated Reminders – Utilize hylobiz automated reminders for overdue payments to gently nudge clients without manual intervention.

4. Diverse Payment Options – Offer various payment methods to accommodate clients’ preferences, speeding up the payment process.

5. Streamlined Communication – Maintain open communication with clients, addressing any issues promptly to prevent payment delays.

How to do accounts receivable reconciliation?

Here’s how you can perform accounts receivable reconciliation with Hylobiz:

1. Access the Hylobiz Dashboard – Log in to your Hylobiz account and navigate to the dashboard, where you can find an overview of your accounts receivable.

2. Review Outstanding Invoices – Use the platform to identify outstanding invoices. We provide a clear view of invoices that are awaiting payment.

3. Compare with Financial Records – Cross-reference the information in Hylobiz with your financial records. Ensure that all transactions, including payments and adjustments, are accurately reflected.

4. Automatic Reconciliation – Our solution can match payments received with corresponding invoices, reducing the manual effort required for reconciliation.

5. Utilize Automation for Accuracy – We provide automation features to improve the accuracy of the reconciliation process. It reduces the chances of manual errors and ensures efficiency.

By following these steps and utilizing the features provided by Hylobiz, businesses can streamline the accounts receivable reconciliation process, reducing errors and ensuring the accuracy of financial records.