Are you struggling with payment collections and cashflow management?

Is the constant chase for payments causing your business to suffer? Struggling to maintain your business due to unpredictable cash flow? Look no further, because we have the perfect solution for you!

Introducing Hylobiz, the ultimate platform equipped with remarkable features, designed to boost your collections and improve your cash flow.

What is CashFlow?

Cashflow refers to the inflow and outflow of money within a business. It is used to describe the flow of funds produced by operational activities, financing, and investments.

Cash flow becomes unpredictable and unstable if we do not monitor it properly. Managing cash flow effectively is vital for business growth and maintaining financial stability. Hylobiz helps businesses track their cash flow, identify potential gaps, and make informed financial decisions.

How Delayed payment collections impact cashflow?

Delayed payment collections have a negative impact on cash flow.

- It reduces available funds for immediate expenses.

- Increase borrowing costs and strain supplier relationships.

- It is challenging to meet financial obligations.

- It increases stress and financial pressure on business owners and management.

- Difficulty in managing day-to-day operations and covering payroll expenses.

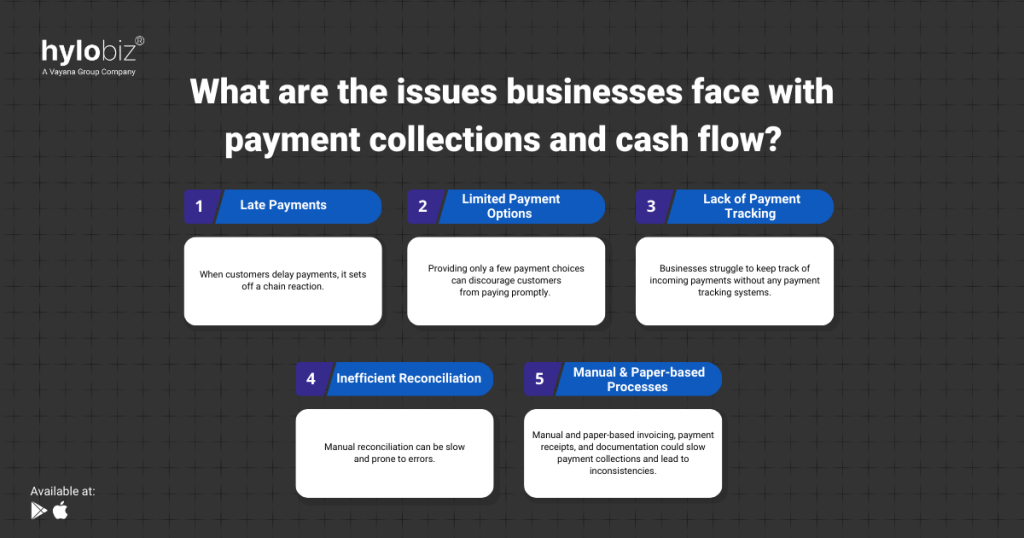

What are the issues businesses face with payment collections and cash flow?

Businesses face a wide range of issues as they try to get through the complex world of payment collections and cash flow management. Here are some common issues they face:

Late Payments

When customers delay payments, it sets off a chain reaction. It slows down invoice settlements and disrupts the flow of funds, causing cash-related problems and impacting daily business operations.

Limited Payment Options

Providing only a few payment choices can discourage customers from paying promptly. Businesses must offer convenient and secure payment options that cater to various customer preferences. Limited payment options may result in missed or delayed payments, which impacts the cash flow.

Lack of Payment Tracking

Businesses struggle to keep track of incoming payments without any payment tracking systems. Planning and forecasting cashflow accurately becomes difficult without this information. It’ll be difficult to manage resources and predict when payments will be made.

Inefficient Reconciliation

Manual reconciliation can be slow and prone to errors. Matching payments with invoices, spotting discrepancies, and updating records manually requires more time and effort. It causes delays in identifying unpaid payments, ultimately impacting cash flow management.

Manual and Paper-based Processes

Manual and paper-based invoicing, payment receipts, and documentation could slow payment collections and lead to inconsistencies. This outdated method is difficult to maintain records and increases the risk of errors. These challenges can significantly affect a business’s financial health and hinder its growth.

Hylobiz helps businesses in overcoming these challenges by automating cashflow management and payment collection processes.

How does Hylobiz assist in Boosting collections and Improving cash flow?

Hylobiz provides a range of features and solutions that effectively boost collections and improve cash flow for businesses. Here are a few of them that assist in overcoming these challenges:

Payment Links

Hylobiz provides payment links for businesses to aid in better payment collection. By providing customers with convenient and secure digital payment options, businesses can encourage prompt payments, leading to better collections and enhanced cash flow.

Payment Reminders

Hylobiz automates payment reminders and facilitates seamless communication between businesses and their customers. Timely reminders encourage customers to make payments on time, reducing the number of outstanding invoices.

Automated Reconciliation

Hylobiz automated the reconciliation process by integrating with ERPs like Tally, ZOHO etc eliminating the need for manual matching of payments with invoices which saves you time and reduces errors.

This approach ensures efficiency and accuracy, leading to faster fund availability and better cashflow for businesses.

Gain Real-time Visibility into Transactions and Cash Flow

Dashboard & Reports

Hylobiz offers comprehensive dashboards and reports to effectively monitor cash flow. It provides businesses with real-time insights and analytics regarding their financial transactions. Users can track incoming and outgoing payments, view payment statuses, generate payment reports, and gain a clear overview of their cash flow performance.

By having clear visibility into payment progress, businesses can take measures to follow up on delayed payments.

Don’t let sluggish collections and cash flow issues hold your business back any longer.

Unlock the full potential of Hylobiz and see your financial success rise to new heights.

Click here to know more and experience the future of efficient payments.

Conclusion

Hylobiz provides a comprehensive solution to tackle payment collection and cash flow challenges for businesses. Offering convenient payment options, real-time tracking, reminders, and automated reconciliation, Hylobiz enables businesses to enhance collections, optimize cash flow, and attain financial stability.

Ready to experience the transformative power of Hylobiz and boost your collections while improving cash flow?

Book demo today and see how Hylobiz can revolutionize your payment management processes.

Frequently Asked Questions

What are the two types of cash flow?

The two types of cash flow are

– Operating Cash flow

It refers to the money that comes in and goes out from a business on a daily basis. It includes cash received from selling products or services and cash paid for expenses like salaries, rent, and supplies.

– Financial Cash flow

It deals with the money that comes in and goes out related to a company’s financing activities. This includes cash received from borrowing money, issuing stocks, or other sources of funding, as well as cash paid for things like paying off loans or buying back stocks.

How to maintain steady Cashflow?

To maintain a steady cash flow:

– Monitor income and expenses.

– Invoice promptly.

– Control expenses.

– Manage inventory efficiently.

– Project cash flow.

– Create a budget.

– Build a cash reserve.

– Negotiate payment terms.

– Diversify customers.

– Consider financing options.

What is cash flow automation?

Cashflow automation is the practice of streamlining and automating the process involved in controlling cash flow via the use of technology and software. It involves automating tasks such as invoicing, payment collection, expense tracking, and cash flow forecasting.

How to calculate Cashflow?

To calculate the cash flow, deduct the total cash inflows such as sales revenue, investments, and loans received from the total cash outflows such as costs, loan repayments, and taxes.

The resulting figure represents the net cash flow, indicating whether the business generated positive or negative cash flow during a specific period.

What are the best strategies for managing cashflow in a small business?

The best strategies for managing cash flow in a small business include:

– Create a detailed cashflow forecast.

– Monitor your cash flow regularly.

– Negotiate favorable payment terms with suppliers.

– Offer incentives for early customer payments.

– Maintain a buffer of cash reserves.

– Control expenses and minimize unnecessary costs.

– Implement effective inventory management.

– Consider leasing instead of purchasing.

– Establish strong relationships with lenders and explore financing options.