In today’s competitive business landscape, providing an exceptional customer experience is crucial for growth and success. That’s where Hylobiz steps in, offering a game-changing solution to transform the way you handle payments.

By offering multiple payment options through an innovative platform, Hylobiz empowers businesses to cater to their customer’s needs and preferences.

In this blog, we delve into the world of payments with Hylobiz, exploring the value of providing multiple payment choices.

Why Providing Multiple Payment Options is Necessary for a Business?

By offering various online payment choices, businesses meet the preferences and needs of their customers. This results in expanding the potential customer base.

Here are a few reasons why multiple payment options for small businesses are essential:

- Offering multiple options makes it easier for customers to complete their transactions. Different customers have different preferences when it comes to payment methods. By providing a variety of options, businesses cater to a wider customer base and enhance convenience for all customers.

- Some customers may not have access to certain payment methods or may be hesitant to provide their card details online. By providing multiple payment choices, businesses can lead to increased sales & conversion rates by capturing a wider audience.

- Trust and credibility are built when businesses offer safe and multiple payment channels, encouraging repeat purchases and referrals.

- Businesses can reduce cart abandonment by providing multiple payment channels and encouraging customers to complete their purchases.

- Multiple payment choices give businesses a competitive edge, setting them apart from competitors with limited payment channels.

What are the Issues Businesses Face with Limited Payment Options?

Businesses that have limited payment options may encounter several issues that can impact their operations and customer satisfaction.

Some of them are:

- Reduced Customer Convenience – When businesses offer limited options for payment, such as accepting only cash or a specific type of credit or debit card may cause inconvenience to customers. Then, customers may look out for competitors with more payment choices.

- Competitive Disadvantage – Customers often seek convenience and flexibility in their purchasing experience. If they can’t find their preferred option, they may choose competitors who can meet their needs.

- Cashflow Challenges – If a business relies solely on cash payments, it may face cash flow challenges. Cash-based transactions are prone to errors, theft, and inefficiencies. Reconciling those transactions is time-consuming and may lead to delays in reporting.

- Increased Security Risks – Limited payment choices may force businesses to rely on other payment systems which might be less secure. Relying on outdated or less secure payment methods might put businesses and their clients at risk.

- Inadequate Tracking and Reporting – Limited payment options may result in inadequate tracking and reporting capabilities. Modern payment platforms provide businesses with detailed transaction records like total collections, collected, and due.

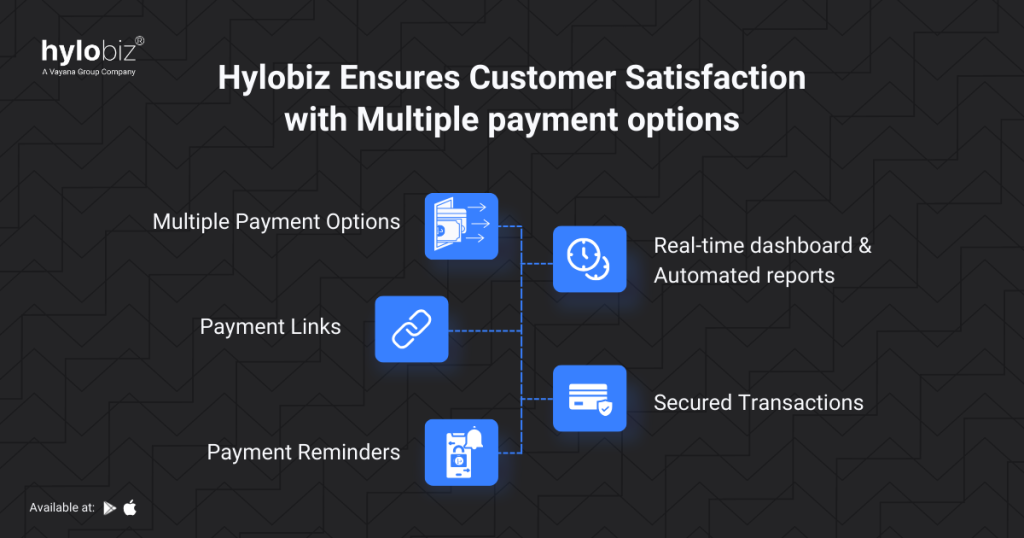

How Hylobiz Ensures Customer Satisfaction with Multiple Payment Options?

Hylobiz addresses these issues by seamlessly integrating multiple payment channels, offering payment links, Payment Reminders, a real-time dashboard, and prioritizing security.

Faster Collections

- Multiple Payment Options – Hylobiz allows businesses to provide multiple payment methods like cash, credit or debit cards and cheques. This reduces the likelihood of customers abandoning their purchases or seeking out competitors with more diverse payment choices. This flexibility improves customer convenience and purchasing experience.

- Payment Links – Businesses can offer a range of choices with the Hylobiz payment links feature. This allows businesses to effortlessly generate personalized payment URLs which can be shared with customers using various communication channels such as emails, WhatsApp and SMS. It helps eliminate the competitive disadvantage and provides better customer experience which also helps attract more customers and boost sales.

- Payment Reminders – Hylobiz provides an automated payment reminders feature to help businesses send notifications to customers who have outstanding payments or pending invoices. This helps businesses streamline their accounts receivable process and minimize the occurrence of late or missed payments. This feature helps businesses maintain healthy cash flow and enhances customer satisfaction.

Accurate Tracking with a Real-Time Dashboard and Automated Reports

Hylobiz’s real-time dashboard provides businesses with valuable insights into payment trends, the status of paid and unpaid invoices and cash flow in real time.

This helps businesses to monitor and analyze customer preferences so that they can optimize their payment offerings. Thus enhancing overall operations and customer satisfaction.

Secured Transactions

Limited payment choices may force businesses to choose alternate platforms, they might be less secure or even have fraudulent payment methods.

To solve this, Hylobiz uses data encryption and also provides two-factor authentication to protect businesses and their clients from potential security threats. It ensures a safe transaction environment and reduces the risks associated with limited payment choices.

Conclusion

In summary, Hylobiz revolutionizes businesses’ payment options, empowering them to enhance customer experience.

With multiple payment choices and innovative features like Payment Links, businesses can boost sales, and provide convenience, and security. It helps gain a competitive edge in the market.

Ready to transform your business’s payment experience? Start offering multiple payment options with Hylobiz.

Hylobiz unlocks the potential for increased sales, customer satisfaction, and competitive advantage.

Book a Demo now and revolutionize your payment process.

Frequently Asked Questions

What are the most common payment options?

The most common payment option includes cash, credit/debit cards, bank transfers, and digital wallets like PayPal, Apple Pay, and Google Pay. These methods offer convenience and security for various transactions, both online and offline.

What are Etisalat bill payment options?

Etisalat provides multiple bill payment options including:

Quick Pay- Pay your bills online using your account number without logging into the platform.

Business Mobile App- Manage your accounts on the go through our Business mobile app.

Etisalat Smart Payment Machines- Pay your bills by Cheque, card, or in cash through a wide range of e-kiosks across UAE using your Party ID or B2B reference number.

Online Bank Payment- Use your online banking portal for quick and easy bill payments Make your payment through your online banking.

Which payment method is better?

The better payment method depends on individual preferences. Credit/debit cards are widely accepted everywhere. Digital wallets provide more security and ease of use for online purchases. Ultimately, it’s important to choose a secured payment option that suits your needs and availability.

How do you the online payments?

To make an online payment, first, choose a trusted payment method like a credit/debit card or

digital wallet.

Then, the platform will redirect you to the payment page based on your choice.

Enter the payment details and confirm the transaction. Always ensure the website’s security before making payments.

How many types of payments are there?

There are several types of online payment options available.

It includes cash, checks, credit/debit card payments, bank transfers, mobile payments, and

online payments through digital wallets.

Each method has its advantages and is suited to different scenarios, making it easier

for people to do transactions in various ways.